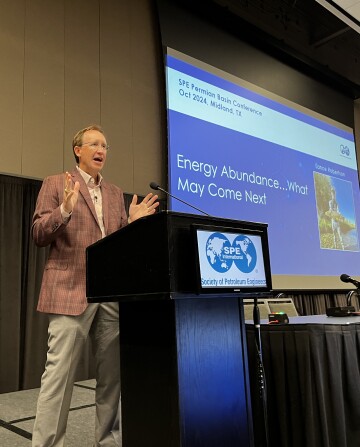

Former CEO Lance Robertson: Permian Basin Outlook Strong

With finite oil reserves, infinite innovation will allow the Permian to endure.

Jennifer Pallanich

Journal of Petroleum Technology

Even as the world faces the threat of full-scale war in the Middle East and oil prices fluctuate, former Endeavor Energy Resources CEO Lance Robertson is confident the industry can adapt. Addressing SPE’s Permian Basin Energy Conference in Midland, Texas, on 22 October, the CEO for the company recently purchased by Diamondback Energy said the outlook for the Permian is busier than ever and that the region’s contribution to the energy mix will be necessary to meet growing demand for the foreseeable future. The growth of oil production from the Permian Basin over the past decade has underpinned the nation’s growth, he said. “The last 5 years, the only oil growth in the entire world has been in west Texas,” he said. “The gas side is equally impressive, though; in west Texas today, gas has almost no value based on differentials.” The region produces “an enormous amount of gas” but lacks local consumption and transportation to unlock the value of that gas, Robertson added. Over the past 10 years, oil production from the Lower 48 has grown from 2 million BOPD to 11 million BOPD. “We are the largest hydrocarbon producer on the planet, and 10 years ago, we weren't even in the top five,” he said, calling the Permian “America's unique asset.” Oil and natural gas have created an energy trade surplus in the US for the past decade, upending a negative trade balance with the rest of the world, he said. “For the last 5 years, we've had a positive trade balance. It's largely been oil exports, petrochemical exports, NGL [natural gas liquid] exports, and liquefied natural gas exports. That is the driver of trade balance in the United States. It's a huge economic tailwind of the country, and it starts here. It starts with you.”

The Energy Mix

Robertson said wind and solar are contributing less to the energy mix in the US than they are globally, based on data from Liberty Energy’s Bettering Human Lives report. “If you look at wind and solar, unreliable intermittent energy, their cumulative impact over the last 10 years in the United States is really almost negligible. Based on what we were hearing in the media, what we look at in government policy, and certainly our tax incentives, this would be the most important thing in the whole world. It's really not making an impact in the US,” he said. Globally, he said, wind and solar have made “a bit more” of an impact over the last decade, although wind’s growth has largely replaced the decrease of biomass as a fuel source. He believes wind and solar will have “a huge impact” on the world over the next 30 years. “An energy abundance means all of the above, in my view. And I think the whole world's going to need all of it. So, I'm not saying it's bad. It's just it hasn't been the impact that the media would have us believe it is.” Energy efficiency will continue to be important, he added, especially with the Energy Institute’s recent report estimating that energy demand will double by 2050.

“Today, the demand is just shy of 600 exajoules, and we're going to double that in the next 15 years. That will be the fastest pace of doubling in human time, and where's all that going to come from?” he asked. “We're going to do a lot more of everything. We need more of what we do. We need more of what everybody does. Because there isn't a single source that can fill a doubling in demand in the next 15 years.” And even with the expectation that oil and natural gas will continue to supply a major portion of the energy mix, it can be difficult for oil companies to commit to investing in major projects. “It's hard to plan a budget for 1 year or 5 years” when oil prices fluctuate as much as they do, he said. “Let's just look at 10 years. If you look at the last 10 years, it turns out that is every bit as volatile as the other 80 years. It goes up and it goes down.” And the current geopolitical turmoil is a complicating factor, he said. “We actually are kind of standing right on the toes of the cliff of full-blown Middle East war, which hasn't happened in about 45 years. And anything could happen. It feels terrifying in a lot of ways,” Robertson said. And as scary as the potential for Middle East war is right now, he said, the market currently pricing oil around $70/bbl doesn’t reflect that risk or the risk that OPEC might bring back online shut-in capacity. “I think there’s a reasonable chance that oil (price) starts with a 5 before the end of the year,” he said. “It’s hard to plan your next year budget cycle. You know, oil’s going to be $50 (per barrel) or it’s going to be $80. That’s a really, really wide range.” However, he said, he believes that as long as oil prices remain at above $60 or $65, activity will remain relatively flat and that most could “make a profit” even if it’s not as large a profit as they’d like. Right now, the Permian is busier than ever, developing 5,400 wells per year. “That’s the same as all the other basins in North America combined,” he said. “No one's ever been busier in the history of the oil field, at least drilling more viable wells than Permian is today.” And even though oil resources are finite, he believes the industry will continue to find ways to innovate and extract more resources from the reservoirs. “There's going to be production, large-volume production for many, many decades. It just won't look the same,” he said. “I'm confident whatever we're going to do next decade will look a little different than this decade.”

The Journal of Petroleum Technology, the Society of Petroleum Engineers’ flagship magazine, presents authoritative briefs and features on technology advancements in exploration and production, oil and gas industry issues, and news about SPE and its members.

ISSN: 1944-978X (Online)

ISSN: 0149-2136 (Print)

No comments:

Post a Comment